THE EFFECT OF DIVIDEND

DISTRIBUTION ON SHARE RETURN

IN CHILE

MAURICIO NASH1, DARCY FUENZALIDA

1Universidad Técnica Federico Santa María

Department of Industries. Las Nieves 3435 Dept. 116, Vitacura, Santiago, Chile. Tel.: 56-2-2062508. Fax +

56-2-2060134. mauricionash@yahoo.com

Fecha de recepción: 8-3-2004 Fecha de aceptación: 12-7-2004

ABSTRACT

Numerous studies relating to the

field of dividends have been carried

out over the past twenty-seven years.

The objective of this paper is to contrast

it with the Barclay study (1987)

and to complement the Venkatesh

paper (1989).

This piece of research concludes that,

contrary to Barclay´s findings, on

their postclosure date, share returns

in Chile do not fall in the amount of

their dividend, owing to the fact that

in this country the effect depends on

the type of dividend. Finally, and as

a complement to the Venkatesh study,

it was determined that the average

volatility of the twenty-five days

prior to closure is lower than that

evinced in the twenty-five days after

closure.

KEYWORDS

Dividend; Clientele Effect; Cutoff

Date; Dividend and Capital Gain.

JEL classification: G10,G12 and G19

INTRODUCTION

Chilean corporations are compelled

by law to distribute at least 30% of

their liquid profits. This makes it extremely

important to measure the

impact of dividend distribution on

share returns.

Various domestic and international

studies have analysed the issue over

the past twenty-seven years. The

principal objective of this piece of research

is to contrast the international

evidence provided by the Barclay

study (1987) that examines share

price behaviour on the day after the

closure of the register of shareholders

with a right to dividend payments. It

was concluded that post-closure share

returns fall in an amount that is

equal to that of the dividend, in other

words investors value dividends and

capital gains as a perfect substitute.

Another objective is to complement

the Venkatesh study (1989), that concludes

that the volatility of share returns

is lower in the period that follows

the announcement of a dividend,

which would be explained by a

lower uncertainty regarding the conditions

of the corporation. So, contrary

to what happens in the period that

precedes the announcement of a dividend,

investors give less importance

to unverifiable information or to

information based on rumour.

Our main objective is to determine if

investors in Chile value dividends

and capital gains as a perfect substitute,

and our secondary objective is

to study the volatility of share returns

on the days that follow the closure

of the register of shareholders with

a right to dividend payments, thus

complementing the Venkatesh study,

which analysed volatility before and

after the announcement. In this study,

we will measure this volatility on

the date of the closure of the register

of shareholders with a right to dividend

payments.

Initially we analysed dividend policies

and types of dividends in Chile.

Section II describes the most important

studies carried out in the past

twenty-seven years. Section III contains

a methodological description.

Section IV analyses the outcome of

the study, and finally Section V explains

our conclusions.

SECTION I

Dividend policy and types

of dividends in Chile

As an average, companies in Chile

distribute three provisional dividends

per year, plus one compulsory minimum

dividend, which is only paid

when provisional dividends to not

reach the minimum amount to be distributed.

Chilean companies are obliged by law

to distribute at least 30% of their liquid

profits.

Other occasional dividends may be

eventual and additional. The following

is a description of different types

of dividends.

A) Provisional Dividend: The dividend

that the board of directors

agrees to distribute during

the fiscal year, and that is chargeable

to the profits for that period.

This dividend is payable on

a date determined by the board.

B) Definite dividends: These dividends

are classified as follows:

B1) Compulsory Minimum dividend:

The dividend that the shareholders´ meeting agrees to

pay in order to comply with their

obligation to distribute a minimum

of 30% of their liquid earnings

for each fiscal year in the

form of a dividend.

B2) Additional Dividend: This dividend

is a dividend that shareholders

agree to pay over the

legal compulsory minimum dividend.

B3) Eventual Dividend: This is a

dividend that corresponds to the

part of the profits that the shareholders´

meeting has not earmarked

for payment in the form

of a compulsory minimum dividend

or of an additional dividend,

and is to be paid during a

future fiscal year.

On the other had, in order to design

a dividend policy it is necessary to

bear the following in mind:

A) Corporate Fund Requirements:

Companies should analyse

their real capacities to keep up

a dividend flow vis-à-vis the distribution

of probable future cash

flows and their respective positions.

This analysis determines probable

future residual funds. This

is important, as the market values

dividend stability because it gives

an implicit sign in terms of expectations.

B) Liquidity: Companies should

maintain their liquidity in order

to have a higher capacity to pay

up dividends and face the unforeseen

expenses and contingencies

that are typical of growth. This is

important, as in general, those

companies that grow and are profitable

may have a low liquidity

level because they concentrate

their investments on fixed assets

and relatively non-liquid assets.

C) Borrowing Capacity: Companies

should define their borrowing

capacity by establishing their dividend

policies with greater accuracy.

D) Nature of shareholders: When

a company is strictly controlled,

its management can have relatively

easy access to its shareholders´

expectations regarding dividends,

which facilitates the definition

of the latter, and therefore

the vast majority of them are subject

to high tax rates. Consequently,

a low dividend level can be

established, but this should

always be done on the basis of the

existence of real investment opportunities

with positive net current

value (VAN). Higher dividend

levels will be required when

ownership is more diluted.

SECTION II

Empirical evidence

We will now describe important national

and international studies related

to dividend announcements and

payment published over the past 27

years, such as the Jensen and Meckling

(1976) study that established

that agency costs increased according

to the increased dilution of ownership.

This cost represents the divergence

between shareholders and the

administrator, because a lower participation

of outside shareholders in

corporate ownership will result in a

reduced possibility of monitoring and

disciplining corporate administrators,

and this will demand a larger

dividend payment so as to ensure that administrators do not make improper

use of the resources generated

and thus reduce agency costs.

In the area of the factors that determine

dividend payment, Rozlef (1982)

studied the factors that determined

dividend payment: A) External financing

transaction costs, B) The financial

restriction created by operational

leverage and C) Corporate financing

and agency costs. His study points out

that transaction costs are strictly related

to the firm´s level of financial

and operational leverage, because its

dependence on external financing increases

when firm has a relatively

high leverage level. Asquith and Mullins´

(1983) study analyses the case

of the companies that pay dividends

for the first time and states that these

present abnormal returns. The results

of this study indicate that the

beginning of dividend payments and

subsequent dividend increases tend

to strengthen the wealth of shareholders.

Dividends give valuable and

unique information, and constitute a

sign of the performance of a company

and of its projects for the future.

On the other hand Easterbrook

(1984) states that agency costs generated

by the separation of ownership

and control can be brought down by

means of dividend policy. His analysis

is based on the argument that a

greater dispersion generates fewer

incentives to control administration

stock, because every individual shareholder

is forced to bear his own

monitoring costs, while they all capture

the benefit involved. Therefore,

the optimum scenario is that all shareholders

monitor their stock as a

group, because if this isn´t the case,

nobody will achieve control This leads

to the appearance of free-riders.

We also have the relevant contrasting

work carried out by two important

researchers. On the one hand, we

have Miller and Rock´s (1985) study

regarding the asymmetry of information

existing among insiders (administrators)

and outsiders (external

investors). This problem emerges

owing to the fact that as insiders have

more and better information on the

value of a company, dividend payments

would be a signal of current

and future earnings that have not

been observed by outsiders. On the

other hand Jensen´s (1986) study of

free cash flow leads him to conclude

that dividend payment solves the problem

of free cash flow, avoiding the

misuse of these cash surpluses, which

are the surpluses left after realising

all the projects with an 0+ Net

Current Value (VAN) and that are

discounted from the relevant capital

cost rate.

In another important study, Barclay

(1987) refers to the way in which individuals

value dividends and capital

gains the day after the closure of

the registers of shareholders with a

right to receive dividends. He concluded

that the post closure share returns

fall in an amount that is equal to

the dividend, which means that investors

value dividends and capital

gain as a perfect substitute.

On the other hand, in their 1989 study,

Lang and Litzenburg tried to explain

the effect that dividend announcements

had on share prices, contrasting

the hypotheses of signalling and

free cash flow established by Miller

and Rock (1985) and Jensen (1986).

These authors use Tobin´s Q Ratio,

which is a market valuation tool that

measures corporate growth opportunities, defined as the market value

over the replenishment of the investment,

establishing that those companies

that present a QSIGNO1 evince

over-investment (they invest in projects

with a < 0 Net Current Value

(VAN) and correspond to a free cash

flow hypothesis. They find that in the

case of dividend changes, the average

return is higher for companies that

present Q < 1, in other words, that

the market reacts more strongly

when the company is over-investing.

Therefore, in the case of Q> 1, a dividend

increase is a good sign, while in

the case of Q< 1, a dividend reduction

is a good sign. It is important to

mention Vankatesh´s (1989) study

when referring to the area of Impact

of Dividend Initiation and the information

contained in Profit Announcements

and Volatility of Returns.

This study determined that as an

average, there is more information

transmitted by profit announcement

in the pre-dividend period than in the

post dividend period, establishing

that in the event of profit announcements,

price reactions are lower in

the post-dividend period as an average,

independently from the fact

that the announcement comes before

or after the dividend announcement.

It also establishes that share

return volatility is lower in the postdividend

period, which could be explained

by reduced uncertainty on

the conditions of the company. And,

contrary to what happens in the predividend

period, investors give less

importance to information that is

based on rumour, and lacks verifiable

sources.

On the other hand, it is important to

mention the Loderer and Maurer

(1992) study, that refers to the possible

relationship between a dividend

payment and share issue. This study

concludes that there is no relationship

whatsoever between dividend

payment and the issue of new shares,

as these two facts generate different

information. Dividends reflect

expected cash flows, i.e. current and

future profits, while share issue is the

reflection of the price elasticity of the

company.

Another important study is the Jensen,

Solberg, Zorn (1992) paper that

looks into common determiners in

terms of insider ownership, debt and

corporate dividends. In their study

"Simultaneous Determination of Insider

Ownership, Debt and Dividend

Policies" they conclude that the debt,

dividend and insider ownership of a

firm are not only explained by their

specific attributes, but are also directly

related to each other. They also

show that dividend payments are

negatively correlated with the growth

and investment opportunities of a

firm, with their leverage level and

insider ownership, the latter being

coherent with the Free Cash Flow

Hypothesis. It is also important to

refer to the Smith and Watts study

(1992), which covers the industrial

area, averaging the data of individual

companies chosen in each industry.

The study concludes that companies

with high growth opportunities present

low leverage levels, low dividend

profitability and high compensation

levels. On the other hand, large companies

have high dividend returns

and high compensation levels. Finally,

regulation generates high leverage

levels, high dividend profitability,

low compensation levels and a low

frequency of incentive compensation

plan utilisation.

Agrawal and Jayaraman (1994) verify

the theory that both dividends

and debt interest payments are mechanisms

for reducing agency costs

between administration and shareholders,

because they reduce the free

cash flows that the management may

use at its discretion for its own pecuniary

concumption and for investment

in non-profit making projects.

This argument is consistent with

Jensen´s Free Cash Flow Hypothesis.

It is also important to refer to the

Yoon and Starks (1995) study, in which

they look into the relationship between

abnormal returns and Tobin´s

Q ratio, considering control variables

like changes in dividend payment,

dividend performance and company

size. Finally, they conclude that this

relationship is non-existent, so that

their results support the signalling

hypothesis of Miller and Rock (1985).

In Chile, Maqueira and Guzmán

(1997) investigated a sample of shares

traded in the Stock Exchange,

concluding the ex dividend share behaviour

is determined by tax factors

rather than by abnormal returns, and

supports the hypotheses of a clientele

effect on the domestic market, which

is induced by the tax structure that

rules local investors. Another important

study is the Alaluf and de Río

(1999) paper that looks into the

effects of the reduction of Telefónica

Chile dividend policy by 40% to 30%

of its overall profits in 1998, concluding

that the dividend cut did not

produce significantly negative effects

on the company´s share returns prior

to the announcement. This study validates

the signalling hypothesis developed

by Miller and Rock (1985)

that states that unexpected changes

in dividend payments might lead to

a review of expectations, which would

mean eventual changes in share prices.

The Telefónica Chile case shows

that timely and appropriate information

prevents the production of unexpected

changes in a company´s share

returns. Finally, Maqueira and González

presented a paper in Chile in

2003 in which they studied 54 Chilean

companies belonging to different

industrial sectors over the 1996-2003

period. This study establishes the

existence of a trend to use dividends

as a mechanism for transmitting information

to the market, and for

transmitting its current and future

flow expectations. The study concluded

that Chilean administrators and

managers behave in a way that is

consistent with the signalling hypothesis.

On the other hand, they determined

that the variables that represent

historical performance, as

would be the case of past growth and

corporate leverage, are consistent

with Rozeff´s 1982 study regarding

the influence of transaction cost on

dividend decisions. This is inversely

related to dividends in the sense that

higher past growth and/or higher flows

allocated to the fulfilment of fixed

obligations resulted in the payment

of smaller dividends as a way of not

resorting to the capital market to satisfy

expensive financing needs.

SECTION III

Data and methodology applied

A) Methodology: We will use a methodology

based on a study of the

processes applied in provisional

and compulsory minimum definite

dividends. We will not study

eventual and additional dividends

as they appear sporadically in these

dividend processes. The objective of this exercise is to measure

their impact on share returns in

terms of the cut-off date for enrolling

in the register of shareholders

with a right to dividend payment.

We will analyse these

effects on compulsory minimum

dividends and on provisional dividends,

and compare the fall in

share returns on the day after the

cut-off ate, versus the increase in

dividends on the cut-off date itself.

The determination of the 0 cut-off

date is important, because after the

last transaction carried out on that

day it is impossible to gain access to

dividend payment. We will furthermore

analyse 25 correlative previous

transactions, and 25 correlative subsequent

transactions, in order to

come to a conclusion regarding volatility

before and after the cut-off date.

(See Chart 1).

B) Description of the study: We

will calculate the returns of each

share over the entire period of the

study, in order to obtain an aggregate

graphic analysis for compulsory

minimum definite dividends,

and for provisional dividends that

will give the average for the preceding

days, for the cut-off date

and for the days that follow the

closure of the register of shareholders

with a right to receive dividend

payment.

We will also make an individual

analysis according to company for

both compulsory definite dividends

and for provisional dividends.

C) Sample:

- The selection will only include

dividend payments completed

after 1/1/93.

- The selection will only include

dividend payments prior to

31/12/03.

- The shares selected will have

had a stock market presence

of not less that 40%.

- We will select 152 compulsory

definite dividend payments.

- We will select 152 provisional

dividend payments.

- We will select shares that have

evinced 6 or more dividend

processes in the period under

study.

D) Statistical Models: The following

statistical models will be

used to measure returns.

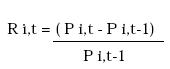

- Share returns for the interval

that exists between one transaction

and another is calculated

as:

where:

P i,t = The price of asset i in transaction

t.

P i,t-1) = The price of asset I in transaction

t-l

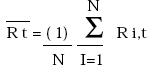

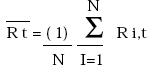

- We will calculate the average

returns for the 152 compulsory

definite dividend payments,

and for the 152 provisional

dividend payments. We

will also calculate the average

of each payment in the 25

transactions carried out before the cut-off distribution date

and of the 25 transactions that

followed the cut-off distribution

date.

We will also calculate the average

dividend payments for those shares

that are contained in the sample of

compulsory definite dividend payments

and in the sample of provisional

dividends. Average return is calculated

as follows:

where:

Is the return of the N dividend

payments in transaction

t.

Is the return of the N dividend

payments in transaction

t.

N = Is the total number of observations

R i,t = Is the return of asset i in

transaction t.

t = Is the transaction, which

goes from (-25, 25).

- The increase in the dividend

paid per share is calculated on

the basis of the last transaction

during the closure date,

and is the difference between

the return (dividend included)

and return (dividend excluded).

This gives the division

between the amount of the dividend

and the price on the

closure date.

E) Research Hypothesis: This piece

of research has the aim of proving

the following hypotheses:

- The fall in average share returns

on the date after the cut-off date

is larger than the average increase

of the amounts of the compulsory

minimum dividends on the

cut-off date.

- It is highly probable that the fall

of a company´s average share returns

on the day after the cut-off

date is higher than the average

increase of compulsory minimum

dividends on the cut-off date.

- The fall of average share returns

on the day after the cut-off date

is lower than the average increase

in the value of provisional dividends

on the cut-off date.

- It is highly probable that the fall

of a company´s average share returns

on the day after the cut-off

date is lower than the average

increase in the value of provisional

dividends on the cut-off date.

- Volatility on the days that follow

the cut-off date is higher than the

volatility observed on the days

prior to the cut-off date.

- It is highly probable that the volatility

ratio betwen the days after

the cut-off date/volatility prior

to the dividend´s cut-off date is

higher for compulsory minimum

definite dividends than for provisional

dividends.

SECTION IV

Analysis of results

We calculated the returns of each

share over the entire period of the

study so as to obtain an aggregate

graphic analysis containing 51 share

returns. Each return is the average

of 152 returns, both in terms of compulsory minimum definite dividends

and for provisional dividends, and

will give the average for the days before

the closure of the register, for the

closure date and for the days that follow

the closure of the register of shareholders

with a right to receive dividend

payments. On the other hand,

graphs of the returns were produced

including (green line) and excluding

the value of the dividend (blue line)

in the last transaction on the closure

date. This was carried out in order to

see if the value of the dividend is in

any way related to the fall of share

return (red line).

We also analysed company results for

compulsory minimum definite dividends

over 10 years, and of the 152

dividend payments included, they

affected 19 companies. In the case of

provisional dividends, the 152 payments

only included 6 companies as

in Chile the ratio between provisional

dividends and compulsory minimum

dividends is 3:1, and would explain

the difference in the size of the

sample.

The two types of dividends analysed

show reduced returns on the day after

the closure of the register of shareholders

with a right to receive dividend

payments. This is caused by

the fact that share prices reflect all

the information available in the market.

In other words, if the share is

transferred prior to the closure date,

in includes the dividend, while if the

transfer occurs after closure, the share

price will be lower because the share

was transferred on its own,

without its dividend, thus reflecting

a balanced price.

This paper concludes that in the case

of Chile, share returns after the closure

of the register of shareholders

with a right to receive share payments

do not fall in the amount of the

dividend, and magnitude will depend

on the type of dividend. This is caused

by the existence of the Clientele

Effect in Chile, and it is caused by

the fact that individuals pay different

tax rates according to different types

of income, capital gains or dividends,

and for this reason they select those

shares that have flows that enable

them to minimise tax payments. Therefore,

the existence of personal taxes

makes people in the lower income

brackets prefer high dividend paying

shares.

Chile is a concentrated share market,

and its most important feature is a

high percentage of shares in the

hands of shareholders that pay high

tax rates, and who prefer shares that

pay low dividends. This is the case of

provisional dividends rather than

compulsory minimum definite dividends,

and can be explained by the

fact that investors will maintain portfolios

created to maximise return

rates after tax. This leads investors

to pay high tax rates per dividend, so

they will prefer those shares with low

dividend returns and higher capital

gain returns. As an average, this implies

that the market places a different

value of flows received a capital

gains and dividends.

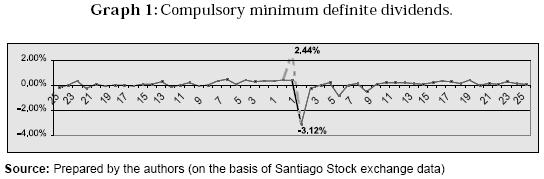

Chart 1 shows that the average of the

152 10 year dividend processes corresponds

to the distribution of compulsory

minimum definite dividends.

This proves one of the hypotheses of

this paper, which is "Average share

returns fall -3.12% on the day after

the cut-off date. This is higher than

the 2.44% average increase of compulsory minimum definite dividends

at the cut-off date". This occurs because

investors place a different market

value on flows received as capital

gain and as dividends. The reason

for this is that the Chilean stock

market has a high concentration of

ownership that produces a higher

percentage of shares in the hands of

shareholders that pay high tax rates

per dividend because they are in the

higher tax brackets. These prefer

shares that pay lower dividends (provisional

dividends) rather than the

high amounts involved in compulsory

minimum dividends, which therefore

produce an excess offer of shares,

which leads to a fall of average share

returns, which is higher than the average

value of compulsory minimum

definite dividends, as can be seen in

Graph 1.

On the other hand, Graph 1 shows

volatility and fulfils other hypotheses

of this paper. On the days the follow

the cut-off date, dividend volatility

reaches 0.69%. This is higher than the

0.21% dividend volatility on the days

prior to the cut-off date. This is caused

by an excess offer the day after

cut-off which makes prices plummet.

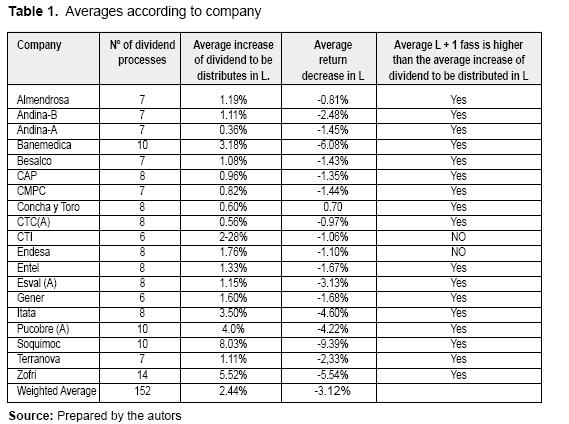

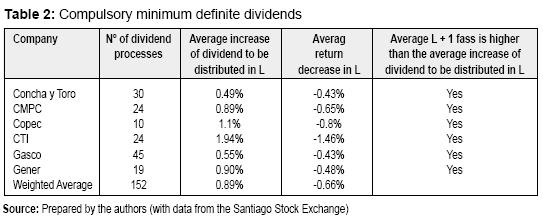

Table 1 shows averages according to

company, and proves one of our hypotheses

"It is highly probable that the

fall of a company´s average share returns

on the day after the cut-off date

is higher than the average increase

of compulsory minimum dividends on

the cut-off date". We see that in the

case of 17 companies, 89.5% of total

average share return falls on the day

after the cut-off date is higher than

the fall of a company´s average share

returns the date following the cut-off

date.

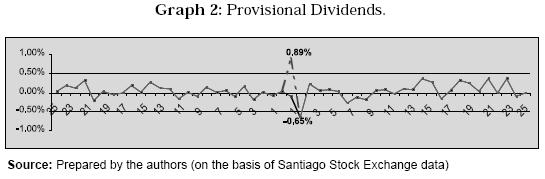

Graph 2 shows that the average of

the 152 10 year dividend processes

correspond to the distribution of provisional

dividends. This proves one of

the hypotheses presented in this paper.

The fall of average share returns

on the day after the cut-off date is

-0.65%lower than the average 0,89%

increase of provisional dividends on

the cut-off date. This is caused by the

fact that investors place a different

value on flows received as capital

gains and as dividends, because the

Chilean stock market has a high concentration

of ownership that producers

a higher percentage of shares in

the hands of shareholders that pay

high tax rates per dividend because

they are in the higher tax brackets

and prefer shares that pay low dividends

(provisional dividends) rather

than shares that pay higher dividends

(compulsory minimum dividends).

The latter are preferred by

shareholders that pay low tax rates

and own fewer shares.

As provisional dividends result in a

lower dividend, shareholders that

have higher share percentages tend

to prefer these dividends that have

lower amounts than compulsory minimum

definite dividends. The consequence

of this is that the fall of average

share returns is lower that the

average increase in compulsory minimum

definite dividends.

On the other hand, Graph 2 proves

the volatility hypothesis presented in

this paper. Provisional dividend volatility

is 0.22% on the days that follow

the cut-off date. This is higher

than the 0.14% volatility rate seen on

the days prior to the cut-off date, and

is the result of an increase in transactions

after cut-off date. On the other hand, when we compare the

ratio: Volatility in the days that follow

the cut-off date/volatility on the

days that precede the cut-off date in

the case of both kinds of dividends,

we see that in compulsory minimum

definite dividends the volatility ratio

for the days after cut-off date/days

prior to the cut off date is 3.28 higher

than in provisional dividends, which

have a ratio of 1.57, because in the

case of compulsory minimum definite

dividends there is an excess offer

on the day after the cut-off date, which

provokes a strong fall in share returns.

Finally, Table 2 shows the average

per company in terms of provisional

dividends, and we see that it proves

our hypothesis "It is highly probable

that the fall of a company´s average

share returns on the day after the cutoff

date is higher than the average

increase of compulsory minimum dividends

on the cut-off date". We see

that in the six companies studied, the

fall of average share returns on the

day after the cut-off date is higher

than the average increase of provisional

dividends on the cut-off date.

SECTION V

Conclusions

The results of this study generate

different conclusions regarding the

effects that different dividends have

on share returns. There is no doubt

whatsoever that the high volatility

seen around the cut-off date is valid

evidence of the existence of the Clientele

Effect in Chile, which is reflected

in the fact that investors change

their stance, according to their tax

preferences, and provoke a different

effect on share returns for provisional

dividends or for compulsory minimum

definite dividends.

Chile is a concentrated share market,

and in the past 10 years its most important

feature is a high percentage

of shares in the hands of shareholders

that pay high tax rates, and who

prefer shares that pay low dividends.

This is the case of provisional dividends

rather than compulsory minimum

definite dividends, and can be

explained by the fact that investors

will maintain portfolios created to

maximise return rates after tax. This

leads investors to pay high tax rates

per dividend, so they will prefer those

shares with low dividend returns

and higher capital gain returns. As

an average, this implies that the

market places a different value on flows

received as capital gains and as

dividends.

On the other hand, the market considers

that the distribution of provisional

dividends on the part of companies

to be positive, because the

company is capable of generating positive

profits and will later be able to

produce the definite dividend established

by law, which amounts to 30%

of its liquid profits.

The following are the specific results

of this paper, which prove its hypotheses:

- Average share returns fall -3.12%

on the day after the cut-off date.

This is higher than the 2.44% average

increase of compulsory minimum

definite dividends at the

cut-off date.

- In 89% of the cases analysed, the

fall of average corporate share

returns the day after cut-off date is higher than the average increase

of compulsory minimum definite

dividends on the cut-off date.

- The fall of average share returns

the day after the cut-off date is -

0.56% lower than the average

0.89% increase in the amounts of

provisional dividends at the cutoff

date.

- 100% of the fall of a company´s

average share returns on the day

after the cut-off date is lower than

the average increase in provisional

dividends on the cut-off date.

- 25 days after the cut-off rate, compulsory

minimum definite dividends

have a volatility of 0.69%,

which is higher than the 0.21%

volatility rate during the 25 days

before the cut-off date.

- 25 days after the cut-off rate, provisional

dividends have a volatility

of 0.22%, which is higher than

the 0.14% volatility rate during

the 25 days before the cut-off date.

- The following is the ratio for compulsory

minimum definite dividends:

volatility after the cut-off

date/volatility prior to the cut-off

date is 3.28% higher than in provisional

dividends, which show

1.57%, This results from the fact

that compulsory minimum definite

dividends produce an excess offer

the day after the cut-off date, which

make share returns plummet.

Finally, it is important to note that

the existence of the clientele effect

on a determined market does not

mean that this should become similarly

apparent in other markets, because

tax structures vary according

to countries, making results completely

different from one country to

another.

For this reason, it would be interesting

to undertake a similar study in

another country so as to contrast results.

Asquith, P. & Mullins, D. (1983) "The

impact of initiating dividend payment

on shareholders´ wealth" Journal

of Business 56 (1): 77-96.

Barclay, M. (1987). "Dividends, taxes

and common stock prices; The ex dividend

day behaviour of common

stock prices before income tax". Journal

of Finance 31-44.

Copeland, T., Koller, T. & Murrin, J.

(2000) Valuation: Measuring and

Managing the value of companies.

New York: John Wiley & Sons.

Gaver, J. & Gaver, K. (1993). "Additional

evidence of the association between

the investment opportunity set

and corporate financing dividend,

and compensation policies".Journal

of Accounting & Economics

16:125:129.

Guzmán, J.P. y Maqueira, C. (1997). "Presencia

del Efecto Clientela en el mercado

chileno". MA Thesis in Finance.

Santiago de Chile: University of Chile.

Jensen M.C., & Meckling, W. (1976).

"Theory of the firm Managerial

Behaviour,agency costs and ownership

structure", Journal of Financial

Economics 3. 305-360.

Jensen, M.C. (1986) "Agency costs of

free cash flow, corporate financial and

takeovers". The American Economics

Review 76 (2): 323-329.

Lang, L. & Litzenberger, R. (1989).

"The effect of personal takes and dividend

on capital asset prices", Journal

of Financial Economics 24 (1):

181-191.

Litzenbergerr, R. & Ramaswamy, K.

(1979). "The effect of personal takes

and dividend on capital asset prices",

Journal of Financial Economics 7:

163-194.

Lease, Ronald, C. (2001). "Política de

dividendos y sus efectos en el valor

de la firma". Boston: Harvard Business

School Press.

Maqueira, C. & Fuentes, O. (1997). "Política

de dividendo en Chile, 1993 y

1994". Estudios de Administración,

Volumen 4 Número 1: 79-112.

Miller, M. & Rock, K. (1985). "Dividend

Policy under Asymmetric Information" Journal of Finance 40: 1031-

1051.

Moncayo, E. (2003). "Factores que inciden

en la política de dividendo en

Chile". MA Thesis in Finance, Santiago de Chile: University

of Chile.

Venkatech, P. (1989). "The impact of

dividend initiation on the information

content of earnings announcements

and return volatility". Journal of Business

62 (2): 175-197.

Ross, Stephen, A. (2002). "Finanzas

Corporativas" Sexta Edición. México: Irwin

McGraw-Hill.

Yoon, P. & Starks, L. (1995) "Signalling,

investment opportunities, and

dividend announcements", The Review

of Financial Studies 8 (4): 995-

1018.

Is the return of the N dividend

payments in transaction

t.

Is the return of the N dividend

payments in transaction

t.